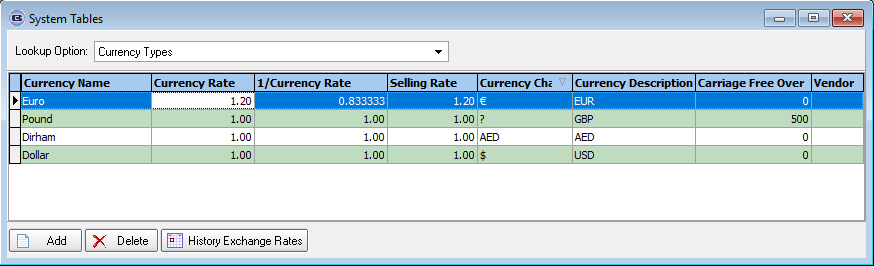

Currency Types¶

The ‘Currency Types’ system table holds currency types, rates, symbols and descriptions thereof.

The ‘Currency’ field in the ‘Customers’ form (Sales Files > Customers > Add/Amend > Currency) refers to this table. A user should choose one

'base' currency and then relate the currency rates back to the base currency.

This table also holds currency symbols and descriptions.

The ‘1/Currency Rate’ field displays the exchange rate the ‘other way round’.

For example, if Pound (GBP) is the default currency and US Dollar

was another currency and the currency rate was entered as 1.55, the filed will display this as 0.64516.

It is possible to edit this field, which

will then update the ‘Currency Rate’ field.

All sales orders look at the selling rate (for both blind and component detail lines).

The ‘Vendor’ field is used for online systems to make payments via Sage. When the vendor is selected for a certain order, the system

finds the details on this vendor required to make payment.

Order Processing > Orders > SI Currency Rate

There is a new field in the Order table called SI Currency Rate. When the order is first saved, this new field will be filled with the Currency Rate from System Tables.

When an invoice is created from an order, it is written again.

When the sales invoice CSV file is generated (if Sage 200 Espi is used), the currency rate in the CSV file is filled with the SI Currency Rate from the order record.

The same process takes place for a credit note, and when a quotation is turned into a sales order.

The CSV file that is generated for a purchase invoice also contains the currency rate which will be taken from the currency rate in the Currency types table at the point the purchase invoice is created.

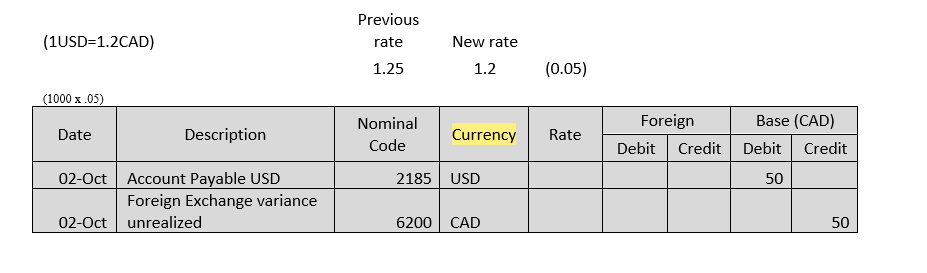

Foreign Currency Functionality (Phase 1)

If Blindata Accounting is switched on, there is a new flag Parameters > Accounting Parameters called ‘Enable Foreign Currency Realization’.

There are two new records in System Tables > Nominal Control Accounts called ‘Exchange Gain Unrealized’ and ‘Exchange Gain Realized’. These records must have nominal codes in them if ‘Enable Foreign Currency Realization’ is switched on.

System Tables > Currency Types

If a currency rate is altered in System Tables > Currency Types, and ‘Enable Foreign Currency Realization’ is switched on, then a window appears saying ‘Foreign currency exchange gain unrealized transactions will now be created for outstanding sales and purchase invoices in this currency’.

A routine will then be run that does as described in Day 2 above (for purchase invoices). For sales invoices the nominal transactions will go to accounts receivable and ‘Foreign Exchange Gain Unrealized’. The transaction id of the sales invoice or purchase invoice will have to be recorded against these two transactions. The transaction type will be FE.

Further work is required to complete the foreign currency functionality.

Sales Receipt Posting

Supplier Payment Posting

Credit Note Entry

There are two fields in this table, one for ‘Denomination Main Unit’ and ‘Denomination Sub Unit’.

These need to be filled for the following currencies:

The ‘Commercial Invoice’ and ‘Export For Invoice’ (Invoice – Bespoke 18) have been changed to take these new fields into account.